Linear Mortgage

The linear mortgage is one of two types of mortgage in the Netherlands which can be deducted from tax. A linear mortgage in the Netherlands is a type of mortgage involving a fixed monthly payment. The payment is determined by dividing the loan amount by the number of payments. The debt and interest payments decrease over time until the mortgage is fully paid off at the end of the term. This type of mortgage is considered cost-effective at the end of the term.

I would like adviceThe advantages of a linear mortgage

A linear mortgage can be advantageous for those who have plans to retire early or anticipate a potential decrease in income during their career. It offers several benefits, including:

- Lower total interest expenses over the entire mortgage term compared to other types of repayment

- Rapid capital repayment from the start of the loan, leading to faster capital growth

- Decrease in risk over time due to the relatively quick repayment

Additionally, a linear mortgage allows for better budget planning. The monthly payments remain constant throughout the entire term of the mortgage, providing stability and predictability. Moreover, it allows borrowers to pay off the mortgage sooner and become debt-free faster.

The disadvantages of a linear mortgage

A linear mortgage can have some drawbacks to consider. They include

- Possibly lower mortgage amount being offered compared to other types of repayment plans

- Reduced mortgage interest relief over the term of the loan

- Tax deduction for a possible relocation or additional loan scheme can be limited as a consequence of possible excess value in the property due to rapid capital repayment

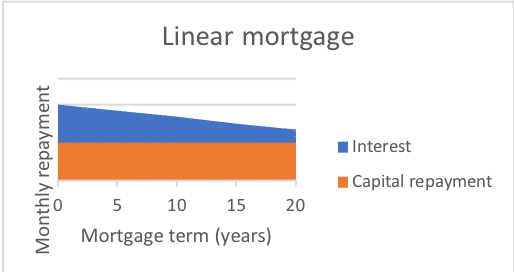

The graph below shows that while the monthly capital repayments remain constant, the interest component is higher in the early years of the loan. However, as the loan term progresses and more of the mortgage is paid off, the interest component reduces. This results in a decrease in overall monthly payments.

Other factors to take into account when choosing your mortgage

A linear mortgage may be the best option for you if you are able to make substantial monthly payments now and if you prefer the idea of paying less in the future. Linear mortgages are also popular with banks as they reduce risk quickly due to the rapid capital repayment in the early stages. However, it is important to consider other factors beyond the type and rate of the mortgage. These include:

- The ability to make extra payments without penalty, which can be useful if you receive a bonus or unexpected windfall

- Fees associated with taking out the mortgage

- Penalties for early mortgage repayment

- Additional costs, such as insurance required by the mortgage provider

Linear vs annuity mortgage

When it comes to mortgage options, another popular choice is the annuity mortgage, which is also eligible for tax deductions. While the payments in a linear mortgage tend to be higher in the first few years, the annuity mortgage maintains a consistent monthly repayment. The total cost of an annuity mortgage is typically higher than a linear mortgage due to a higher amount of interest you pay. However, the initial monthly costs of an annuity mortgage are generally lower which is why it is a popular choice with first-time buyers.

Want to know more about a linear mortgage?

At FVB de Boer, we specialize in mortgages, pensions and other financial matters for expats and we understand the challenges that expats may face when making financial commitments abroad. If you are interested in learning more about a linear mortgage or would like to receive a personalised mortgage calculation, we would be happy to help. We can also provide advice on whether a linear mortgage is the best option for your circumstances. Feel free to contact us via phone or email.

Frequently asked questions about linear mortgages

A linear mortgage is one of the types of mortgages in the Netherlands besides an annuity mortgage and a buy-to-let mortgage. A linear mortgage is a mortgage whereby you pay a fixed monthly amount.

- The total interest expenses over the entire term of the mortgage are lower than with other types of repayment

- The rapid capital repayment from the start of the loan means rapid capital growth

- The risk decreases relatively quickly due to the relatively quick repayment.

How can we help you?

José de Boer

Financial Advisor

FAQ

Buying an apartment to lease out can often be a good investment as, in addition to rental income, an increase in property value can be expected as well.

Obviously you can purchase such properties with your own private cash, however taking out a mortgage has also recently become an option.

The bank may set a few more conditions regarding the rental of the apartment. For instance, a long-term occupation needs to be the case – Airbnb or any other short-term rental is not allowed.

The bank will expect buyers to cover roughly 40 per cent of the purchase price with their own cash.

Please contact one of our mortgage advisors in order to hear how we can help you and which other conditions/requirements apply.

Give us the call and let our team help you plan

the next financial step in your life

Other Services

Mortgage Advisors

At FVB de Boer, we have established good working relationships with a number of Dutch banks to help you realize your dream property.

Home Insurance

FVB de Boer helps you to secure your property with building and fire insurance or home contents insurance for the short or long term.